So, You Want to Be a Business Mogul? The Lowdown on Owning Multiple Businesses

Ever dreamed of owning more than one business? Imagine juggling ventures seamlessly. It sounds thrilling. Picture the empire you could build and the bragging rights at family events. However, before you leap into entrepreneurship, let’s pause. Let’s explore what this really involves.

The Alluring Upside (and Sneaky Downsides) of Business Multiplicity

The idea of having several income sources is quite tempting. It’s an attractive notion, yet it’s only the start of the story.

The Good Stuff: Why More Might Actually Be… More

- Cha-Ching! Potential for Increased Income: More businesses usually mean more cash flow. If one business struggles, others can provide backup. This means you avoid placing all your bets on one risky venture.

- Risk? What Risk? Diversification is Your Friend: Markets change, and industries fluctuate. If you invest in various sectors, the downturn of one will not destroy your entire financial situation.

- Growth Spurt City: Expansion and Conquest: Starting one business is just the beginning. More businesses mean creating a larger enterprise with significant growth potential. Picture it as a board game with real stakes.

- Brand Chameleon: Flexibility is the Name of the Game: Want to offer knitted dog clothes and run a construction firm? With distinct brand names, it’s feasible to keep things separate and clear for your clients.

- Tax Tango: Flexibility in the Tax Department: Many LLCs lead to some interesting tax opportunities. We’ll dive into tax specifics soon, but having options is beneficial when facing tax obligations.

Hold Your Horses: The Not-So-Glamorous Side

- Wallet Woes: Financial Tightrope Walking: Every business demands an investment. Starting multiple businesses increases these initial costs rapidly.

- Stress City and Health Havoc: Prepare for Burnout: Managing one business may be challenging. Handling several feels like trying to balance too many tasks at once. This can lead to stress and health issues.

- Time, Glorious Time… Or Lack Thereof: Where Did It Go?: Time is limited and businesses consume it. Splitting focus among several enterprises can lead to exhaustion.

- Management Mayhem and Taxing Times (Literally): Complexity Galore: Managing different businesses complicates everything. Taxes will become more overwhelming as you learn new forms.

- Paperwork Palooza and Hidden Costs: Fees, Forms, and Frustration: More businesses equate to more paperwork. Expect extra fees, legal documents, and tons of tax forms.

- Conflict Catastrophe: Potential Internal Squabbles: If you operate multiple DBAs under a single LLC, interest conflicts may arise. Picture siblings arguing over TV time, but with serious financial stakes.

- Liability Limbo (with DBAs): Shared Risk Alert: All DBAs share risks under one LLC. If one gets sued, it affects all their operations.

- Resource Drain: Overextension Overload: Stretching your energy too thin is detrimental. Attempting too many things without sufficient resources may spell disaster.

Structure Showdown: How to Organize Your Business Bonanza

If you’re committed to this path, congratulations! Next, we need to discuss how to structure your ventures. Good organization is key. Think of it like building a home with a solid base.

Your Structural Arsenal: The Options Unveiled

- Option 1: Go Solo (Entities, That Is): Separate Legal Entities

- Multiple LLCs (Limited Liability Companies): Each business becomes its own kingdom with legal protection.

- Multiple Corporations: Similar to LLCs, but with distinct tax strategies. Corporations suit larger operations.

- Option 2: United Front (Under One Roof): One Legal Entity

- One LLC with Multiple DBAs (Doing Business As): One main business with several branches, all within a single company.

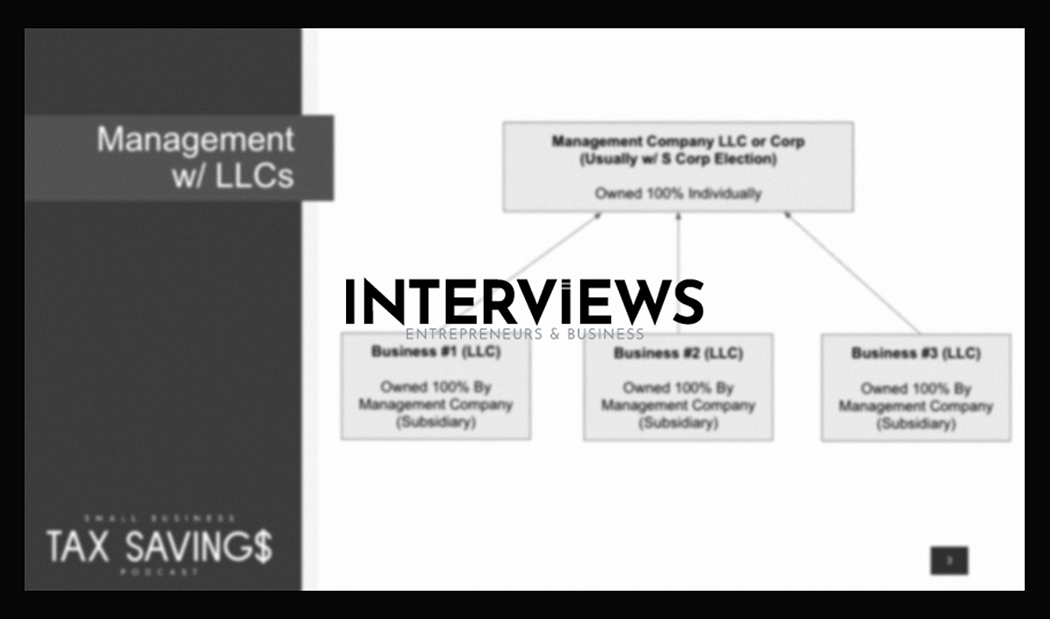

- Umbrella LLC (Holding Company) with Subsidiary LLCs: Picture a large parent company protecting a few smaller businesses.

- Series LLC (State-Specific Special): Some states permit one LLC to create internal divisions, allowing for separate operations within one entity.

Decision Time: Choosing Your Structural Path

- Liability Shield: Protection, Protection, Protection: Having multiple LLCs isolates each business’s liabilities. If trouble arises in one, others remain safe.

- Asset Armor: Shielding Your Stuff: This fosters asset protection among various ventures, shielding from creditor claims.

- Tax Tango, Part Deux: Tax Implications Revisited: Different structures provide various tax impacts. Multi-LLC setups allow for diverse tax classifications.

- Admin Avalanche: Complexity and Costs: More entities entail more work and costs. If simplicity is desired, opt for DBAs under a single LLC.

- Legal Labyrinth: Navigating the Legal Maze: Each structure has unique legal responsibilities. Stay informed about the requirements for LLCs and corporations.

- Strategic Blueprint: The Grand Plan: Your goals should direct your structural choices based on growth and investment.

Structure Deep Dive: Decoding the Details

- 1. Multiple LLCs: The Fort Knox of Business Structures

- The Fortress Advantage: Isolation of Risk: Each LLC stands separately, protecting from liabilities incurred by others.

- Paperwork Pile-Up and Fee Frenzy: The Price of Protection: The downside? More LLCs create heightened paperwork and expenses.

- Real Estate Rumble: A Real-World Example: Real estate often employs multiple LLCs per property to mitigate risk.

- Risk-Free Roaming? Not Quite, But Close: Separate LLCs significantly reduce risks associated with mismanagement.

- 2. Multiple DBAs under one LLC: Streamlined Simplicity (with Caveats)

- Brand Bonanza and Management Made Easier: The Upsides of Unity: DBAs offer flexibility and efficient management compared to multiple LLCs. It’s simpler to oversee one property with distinct rooms than several homes.

- 3. Umbrella LLC (Holding Company): The Parent Protector

- The Shielding Umbrella: Cross-Liability Coverage: An umbrella LLC protects its subsidiaries from each other’s mistakes. Consider it an insurance shield for your business network.

- Holding Pattern: Ownership Structure Defined: An umbrella LLC retains ownership of the subsidiaries, simplifying hierarchy and operational management.

Tax Time Tango: Navigating the Tax Terrain of Multiple Ventures

Ah, taxes. An unavoidable part of business ownership.

Business ownership can feel as fun as a root canal. But do not worry, knowing the tax implications of running multiple businesses can show some benefits.

Tax Perks? They Exist

- Tax Tailoring: Flexibility is Your Friend: Different business structures lead to various tax classifications. You can choose classifications like partnership or S corp strategically for each LLC to reduce your overall tax bill. Think of it like picking the right tool.

- Pass-Through Power: Avoiding Double Taxation: LLCs and S Corps are often pass-through entities. This means business income goes to your personal income tax. This avoids double taxation that corporations face. Less taxes sound good.

- Consolidated Cavalry: Offsetting Shenanigans: Holding companies with 80% or more of subsidiaries can file consolidated tax returns. This allows gains in one subsidiary to cover losses in another, reducing corporate tax liabilities. Think of it like tax loss harvesting.

- Expense Extravaganza: Deduction Delight: Business expenses? Deductible! This applies across businesses. From office supplies to marketing costs, many expenses reduce your taxable income.

- Road Warrior Relief: Travel Tax Breaks: Business travel? Uncle Sam may let you deduct some living costs, like lodging and meals. That makes business trips sound more appealing.

- Health Hero Deductions: Medical Expense Magic: Self-employed owners can often deduct health insurance premiums and other medical costs. Take care of yourself and enjoy a tax break.

- Home Office Harmony: Space-Sharing Savings: Have a home office? Even with multiple Schedule C businesses, you might claim the home office deduction. Maximize that spare room!

Tax Tripwires: Be Aware

- Complexity Cascade: Planning and Record-Keeping: Managing taxes for multiple businesses requires serious organization. Careful planning and precise record-keeping are crucial.

- Paperwork Purgatory: Administrative Overload: Managing multiple LLCs means more paperwork, filing fees, and accounting costs. Consider hiring an accountant who specializes in multiple business structures.

- State Shenanigans: State-Specific Surprises: Tax laws vary greatly by state. Some places may impose annual fees and taxes. Know your state rules to avoid surprises.

- Conflict Cautions: Structure Snags: Ensure your business structures do not create unintended tax conflicts. Proper structuring can save you headaches later.

- Controlled Chaos: C-Corp Caveats: Own more than one C corporation? Watch out for “controlled corporation” rules that may lead to less favorable tax regulations.

Filing Frenzy: Tax Form Fun

- Schedule C Symphony: Separate Schedules: If multiple businesses are unrelated sole proprietorships, you’ll fill out separate Schedule C forms for each. It’s a tax form fiesta!

- Schedule K-1 Chronicles: Sharing the Profits: Pass-through entities use Schedule K-1 to report each owner’s share of profits or losses. You’ll get familiar with this form in the multiple business realm.

Managing the Multitude: Tips to Tame the Business Beast

You’ve structured your empire and navigated taxes, but can you manage it all? Deep breaths. You can do it. Here’s how.

Key Considerations: The Management Mindset

- Team Triumph: Delegate or Drown: Trying to handle everything yourself is a fast track to burnout. Hire strong leaders or contributors. Leverage those talents!

Focus and Firepower: Prioritization Power

- The Golden Goose Rule: Focus on the Top Performer: It’s wise to focus energy on your best business, the one with the most potential. Avoid thinning out attention too much.

- System Symphony: Automate and Delegate: Create systems for efficiency without constant attention. This helps you reclaim your time and sanity.

Title Talk: What to Call Yourself

This is less crucial than tax strategy, but it’s fun to think about your title when owning multiple businesses.

Titles of the Multi-Business Monarch

- Portfolio Entrepreneur: Sounds sophisticated, like you’re curating businesses as fine art.

- Serial Entrepreneur: Implies you’re a repeat starter, launching ventures one after another.

- Multipreneur: A modern term for someone managing multiple businesses.

Classic Titles: Timeless Choices

- Founder: You built it from scratch. Classic and respectable.

- Owner: Simple and direct.

- CEO (Chief Executive Officer): Fits if you’re leading larger ventures.

- Managing Director: This implies a hands-on management role in partnerships or LLC structures.

- President: A strong leadership title common in corporations.

- Principal: Suggests authority, often used in professional services.

Pitfall Patrol: Avoid Business Blunders

Owning multiple businesses is exciting, but let’s face it – businesses can fail. Knowing common issues helps you dodge pitfalls.

Reasons Why Small Businesses Fail

- No Planning: Inadequate Planning is Dangerous: Failing to plan for each venture can lead to disaster. Solid plans are essential.

- Financial Issues: Poor Management Sinks Ventures: Cash flow is vital. Poor financial management across businesses can be a recipe for disaster.

- Insufficient Capital: Running Out of Money Kills Ventures: Ensure each business has enough capital, especially early on.

- Poor Marketing: No Customers Equal No Sales: If people don’t know about your businesses, they won’t buy. Strong marketing strategies are key for attracting buyers.

- Poor Leadership: Weak Leadership Can Cripple Ventures: Strong leadership is vital for guiding businesses to success.

Funding Frontier: Loans and Credit for Builders

Need funds for your multi-business goals? Loans can be a helpful tool. Choose carefully.

Loan Landscape: Your Options

- SBA Loans: Reliable Option: Small Business Administration loans often offer favorable terms, backed by the government.

Loan Logic: Factors to Consider

(Important considerations include interest rates, repayment terms, loan amounts, eligibility requirements, and the loan’s fit for your business needs).

The ups and downs of owning multiple businesses are complex. Not for the faint-hearted, but for the well-prepared entrepreneur, this can lead to building something impressive. Remember, it’s about the quality and sustainability of each venture. Go conquer… responsibly!